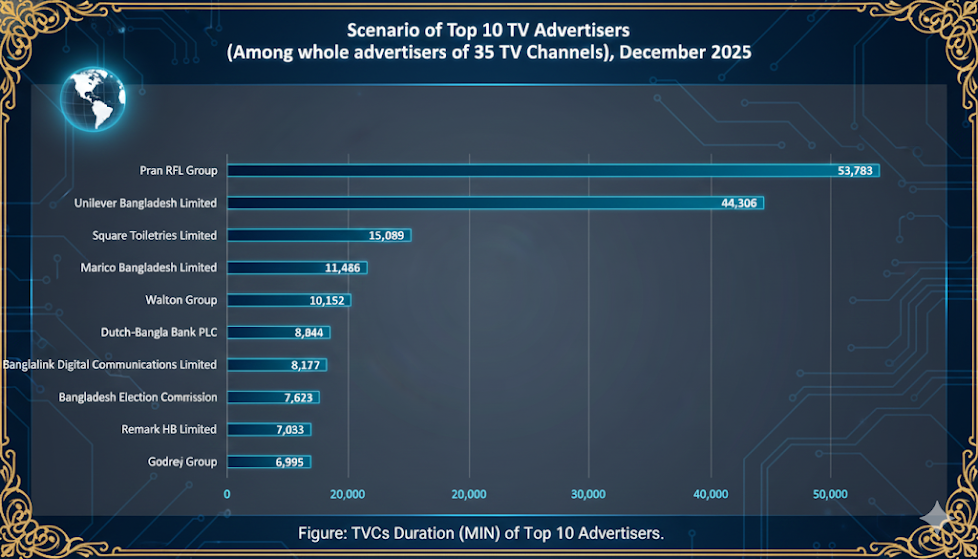

Summary of TV Commercials by Top 10 Advertisers in December 2025

This report provides an analytical overview of television advertising trends in Bangladesh for the month of December 2025. The data examines the total duration of Television Commercials (TVCs) across 35 TV channels, identifying the top 10 entities that dominated the airwaves. The figures are measured in minutes (MIN).

Market Leaders and Dominance

The advertising landscape is heavily dominated by two major players: Pran RFL Group and Unilever Bangladesh Limited.

Pran RFL Group: Leading the chart with a significant margin, Pran RFL recorded 53,783 minutes of airtime. Their position at the top suggests an aggressive multi-product marketing strategy, likely covering their diverse range of food, beverage, and household products.

Unilever Bangladesh Limited: Following in second place, Unilever recorded 44,306 minutes. As a global FMCG giant, their high volume reflects a sustained effort to maintain brand visibility across their extensive portfolio.

Together, these two companies account for nearly 100,000 minutes of advertising, showcasing a massive gap between the market leaders and the rest of the competitors.

Secondary Tier Advertisers

There is a sharp decline in airtime duration starting from the third position. This tier includes companies that, while prominent, utilize significantly less airtime than the top two.

Square Toiletries Limited holds the third spot with 15,089 minutes.

Marico Bangladesh Limited and Walton Group follow with 11,486 and 10,152 minutes, respectively.

The presence of Walton Group highlights the competitiveness of local electronics and home appliance manufacturing in the media landscape.

Service Sector and Public Interest

The lower half of the top 10 list features a mix of financial services, telecommunications, and a notable public sector entry:

Financial & Telecom: Dutch-Bangla Bank PLC (8,844 min) and Banglalink (8,177 min) represent the service industry’s commitment to consumer outreach.

Bangladesh Election Commission: Occupying the 8th position with 7,623 minutes, the Election Commission’s presence is significant. This high volume of "advertising" suggests that December 2025 was a period of intense public awareness campaigns, likely preceding national or local elections.

Emerging and Traditional Players

The list concludes with Remark HB Limited (7,033 min) and Godrej Group (6,995 min). Their inclusion in the top 10 indicates a consistent investment in brand building within the competitive personal care and household sectors.